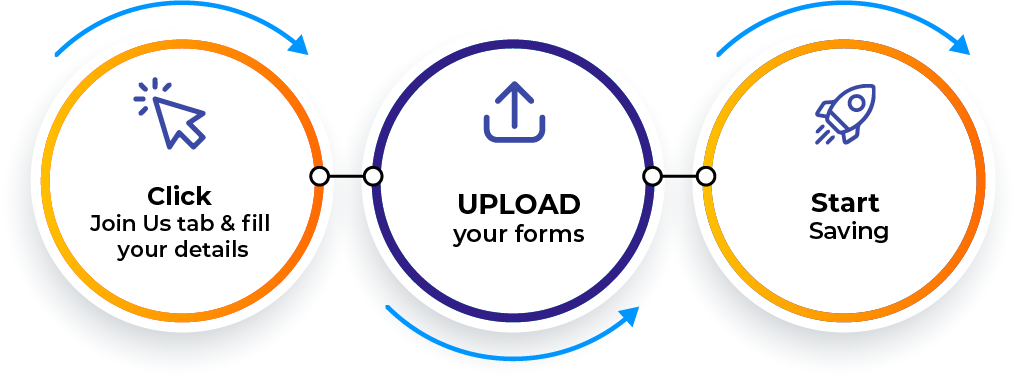

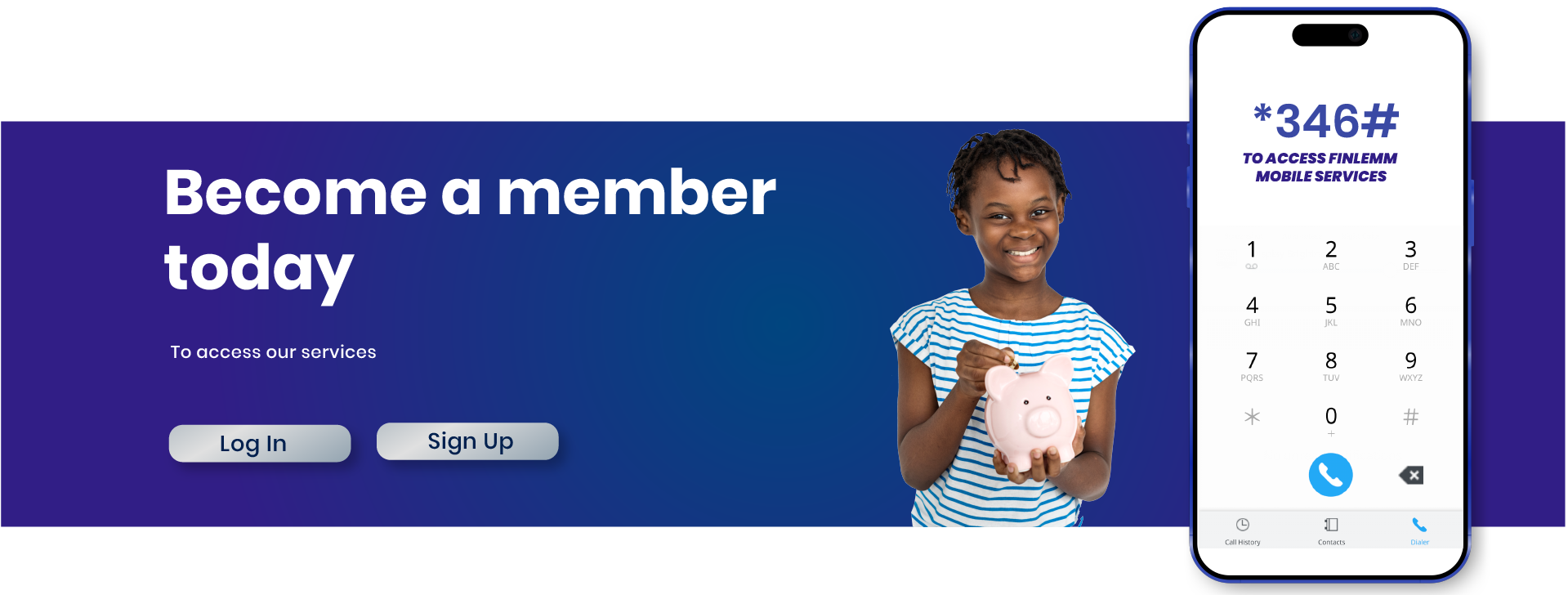

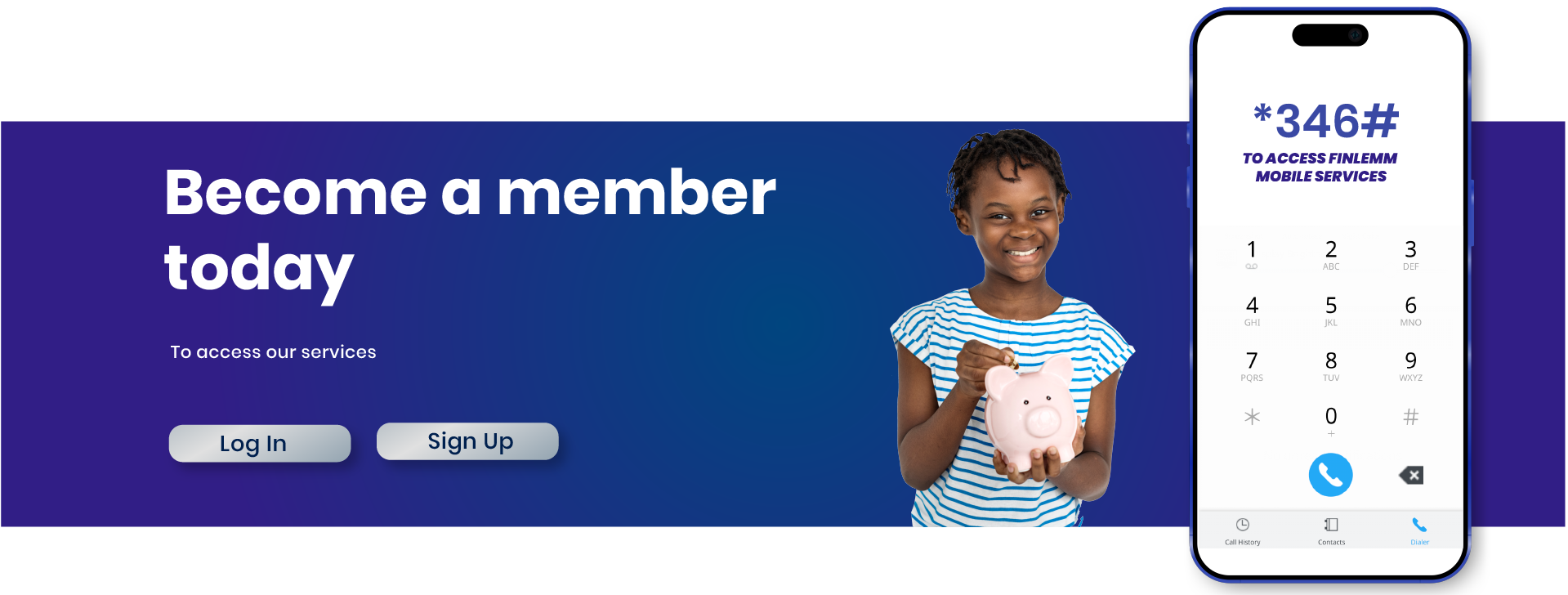

BECOME A MEMBER

TODAY

Membership is open to employees of Diplomatic missions in Kenya i.e Embassies,Local and International NGOs and their affiliates.

0+

HAPPY CLIENTS

0+

PARTNERS

0+

AWARDS RECEIVED

0+

ACTIVE PRODUCTS

Vision Statement:

To be a leader in provision of financial services

Mission Statement:

Enhance the socio-economic well-being of members through efficient mobilization of resources and provision of innovative financial solutions

Core Values:

Customer Focus Excellence (Effectiveness & Efficiency) Integrity Innovativeness Teamwork

Motto:

Your Prosperity, Our Priority

Testimonials

Our Loan Products

Mobile Loans

Includes:

Finn-Pesa

Ustawi Loan

Education Loan

Emergency Loan

Express Loan

Dividend Discounting Loan

Long Term Loans

Includes:

Home Loan

Premium Loan

Development Loan

Plot Loan

Daraja Loan

Inua Chama Loan

Short Term Loans

Includes:

Merchandise Loan

Asset Finance Loan

Corporate Loan

Insurance Loan

Qaribu Loan

Our Savings Accounts

FINNLEMM SACCO is always

ready to help you

Latest News